KraneShares Expands Global Access to Humanoid Robotics Investing With Xetra Listing of KBOT ETF

04 February 2026 | Interaction | By editor@rbnpress.com

Dr. Xiaolin Chen, Head of International at KraneShares, explains why cross-listing the Global Humanoid & Embodied Intelligence Index UCITS ETF on Deutsche Börse Xetra marks a strategic milestone for European investors.

In this interview with Robotics Business News, Dr. Xiaolin Chen, Head of International at KraneShares, discusses the strategic rationale behind cross-listing the Global Humanoid & Embodied Intelligence Index UCITS ETF on Deutsche Börse Xetra under the ticker KBOT. She outlines how the move enhances accessibility for European investors, aligns with rising demand for AI-enabled industrial automation, and positions humanoid robotics as one of the most compelling technology megatrends shaping global manufacturing and services.

What strategic objective does KraneShares have in cross-listing the Global Humanoid & Embodied Intelligence Index UCITS ETF on Deutsche Börse Xetra under the ticker KBOT?

Cross‑listing the Global Humanoid & Embodied Intelligence Index UCITS ETF (LSE: KOID) on Deutsche Börse Xetra under the ticker KBOT represents a significant step in KraneShares’ broader strategy to expand global access to cutting‑edge thematic investment opportunities. Our overarching objective is to ensure that investors across Europe can efficiently engage with the rapidly developing theme of humanoid robotics and embodied intelligence, which we believe will be one of the most transformative technological megatrends of this decade.

The cross‑listing is driven by three core strategic priorities:

1) Increasing accessibility for continental European investors.

While KOID is already available on the London Stock Exchange and Borsa Italiana, Xetra remains the dominant platform for institutional and retail investors across Germany, Austria, Switzerland, and other EU markets. Cross‑listing KOID on Xetra under the ticker KBOT allows us to reach investors who prefer trading within the Eurozone framework, in their local currency, via their existing broker and custody relationships.

2) Supporting our long-term thematic leadership.

KraneShares has always focused on innovation-led themes grounded in structural economic change. Humanoid robotics and embodied AI represent the next evolution of automation, and we aim to position ourselves at the forefront of providing transparent, index‑based access to this emerging sector. By cross‑listing KOID on Xetra under the ticker KBOT, we accelerate the ETF’s visibility in one of the world’s most advanced industrial and manufacturing hubs.

3) Aligning with demand for AI‑enabled industrial transformation.

Europe, and especially Germany, is undergoing a shift as manufacturers adopt advanced robotics to address labour shortages, energy efficiency pressures, and competitiveness gaps. By cross‑listing KOID on Xetra under the ticker KBOT, we are aligning our product availability with the regions where demand for embodied intelligence investment exposure is accelerating the fastest.

Cross‑listing KOID on Xetra under the ticker KBOT is, therefore, a strategic move that enhances KOID’s reach and strengthens our presence in continental Europe.

How does the Xetra listing enhance access for European investors to the global humanoid robotics and embodied intelligence investment theme?

Cross‑listing KOID on Xetra under the ticker KBOT significantly improves access for European investors in several practical and structural ways.

1) Euro‑denominated trading simplifies portfolio integration.

Investors can trade KOID in EUR, reducing the need for FX conversion and making the ETF easier to integrate into Eurozone portfolios. This is particularly valuable for wealth managers, model portfolio builders, and institutional investors with currency‑specific mandates.

2) Broader broker and platform availability.

Xetra is the default execution venue for many German, Austrian, and Swiss investment platforms. Cross‑listing ensures that KOID is visible and tradeable across a much wider range of online brokers, private banks, and discretionary management platforms.

3) Enhanced liquidity through Xetra’s market-making structure.

Xetra provides a deep, transparent liquidity pool supported by robust market-maker participation. This structure typically results in tighter spreads, giving investors more efficient execution when building or adjusting thematic positions.

4) Alignment with investor preference for local exchanges.

European investors—both retail and institutional—often prefer investing through their local exchange infrastructure. Xetra is one of the most trusted and widely used exchanges in Europe. By meeting investors where they already transact, we lower friction and increase the ETF’s reach.

In short, the cross-listing of KOID on Xetra under ticker KBOT makes KOID more accessible, more convenient, and more cost-efficient for the full spectrum of European investors looking to participate in the humanoid robotics and embodied intelligence megatrend.

Can you explain the rationale for choosing Deutsche Börse Xetra specifically for this cross‑listing?

Deutsche Börse Xetra is the logical and strategic choice for expanding the strategy for several reasons:

1) Xetra is Europe’s leading ETF venue by turnover1

For Germany, Austria, and much of continental Europe, Xetra is the primary exchange where ETFs are discovered, researched, and traded. As our goal is to broaden access, making our humanoid strategy accessible on Xetra is very important.

2) Germany is the heart of European industrial innovation.

As the home of world-leading manufacturing giants and robotics integrators, Germany is at the forefront of automation, Industry 4.0, and embodied AI adoption. Investors in this region tend to be exceptionally knowledgeable about industrial and technological transformation and Xetra acts as the gateway to those investors.

3) Xetra’s market structure supports high liquidity and transparency.

The exchange’s strong market-making framework, reliable settlement infrastructure, and investor-friendly trading environment make it ideal for thematic ETFs that benefit from efficient day-to-day trading.

4) Alignment with KraneShares’ pan-European UCITS strategy.

We have a long-term commitment to building our UCITS range across core European markets. Xetra is an important pillar in that strategy, and cross-listing the product is part of our broader push to ensure our ETFs are available wherever European investors prefer to operate.

Ultimately, Xetra offers the optimal blend of investor reach, liquidity, credibility, and strategic alignment with Europe’s industrial innovation landscape.

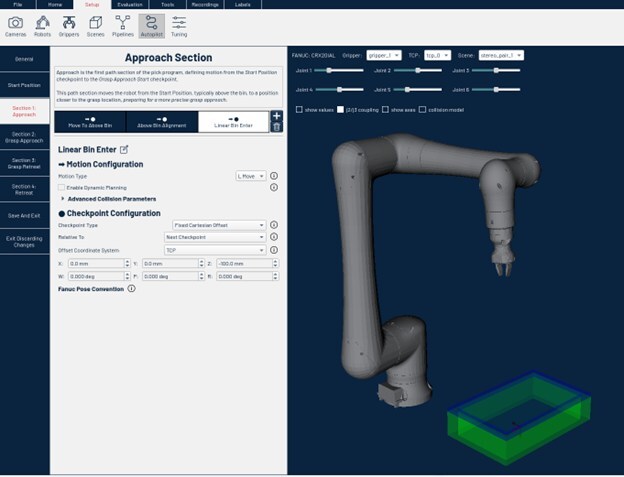

How does the ETF’s investment objective and index methodology remain consistent across its listings on Nasdaq, LSE, Borsa Italiana, and now Xetra?

The investment objective and methodology are identical across listings. The strategy seeks to track the MerQube Global Humanoid & Embodied Intelligence Index, a rules‑based benchmark targeting companies engaged in humanoid robotics and embodied AI across hardware, software, and enabling components. This holds for the U.S.‑listed strategy (KOID on Nasdaq) and the UCITS strategy (KOID/KBOT listings in Europe); the underlying index, objective, and methodology do not change by venue. This consistency ensures that all investors receive the same pure-play exposure to the humanoid robotics megatrend.

In Europe, the UCITS fund is listed on LSE (KOID), Borsa Italiana (KOID), and now Xetra (KBOT); public exchange pages and fund profiles corroborate the cross‑listing and the instrument’s ISIN IE000O6Z73N7.

What trends in humanoid robotics and embodied intelligence make this sector compelling for investors right now?

Humanoid robotics and embodied intelligence are moving from conceptual prototypes to commercial deployment at an unprecedented pace. Several powerful trends are converging:

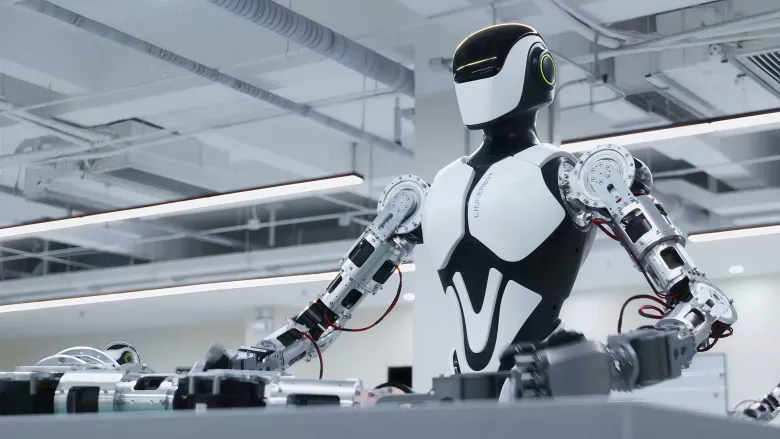

1) Labour shortages in manufacturing, logistics, and services

Structural demographic challenges are accelerating demand for automation. Humanoid robots, capable of operating in human-designed environments, address these gaps more efficiently than traditional industrial robots.

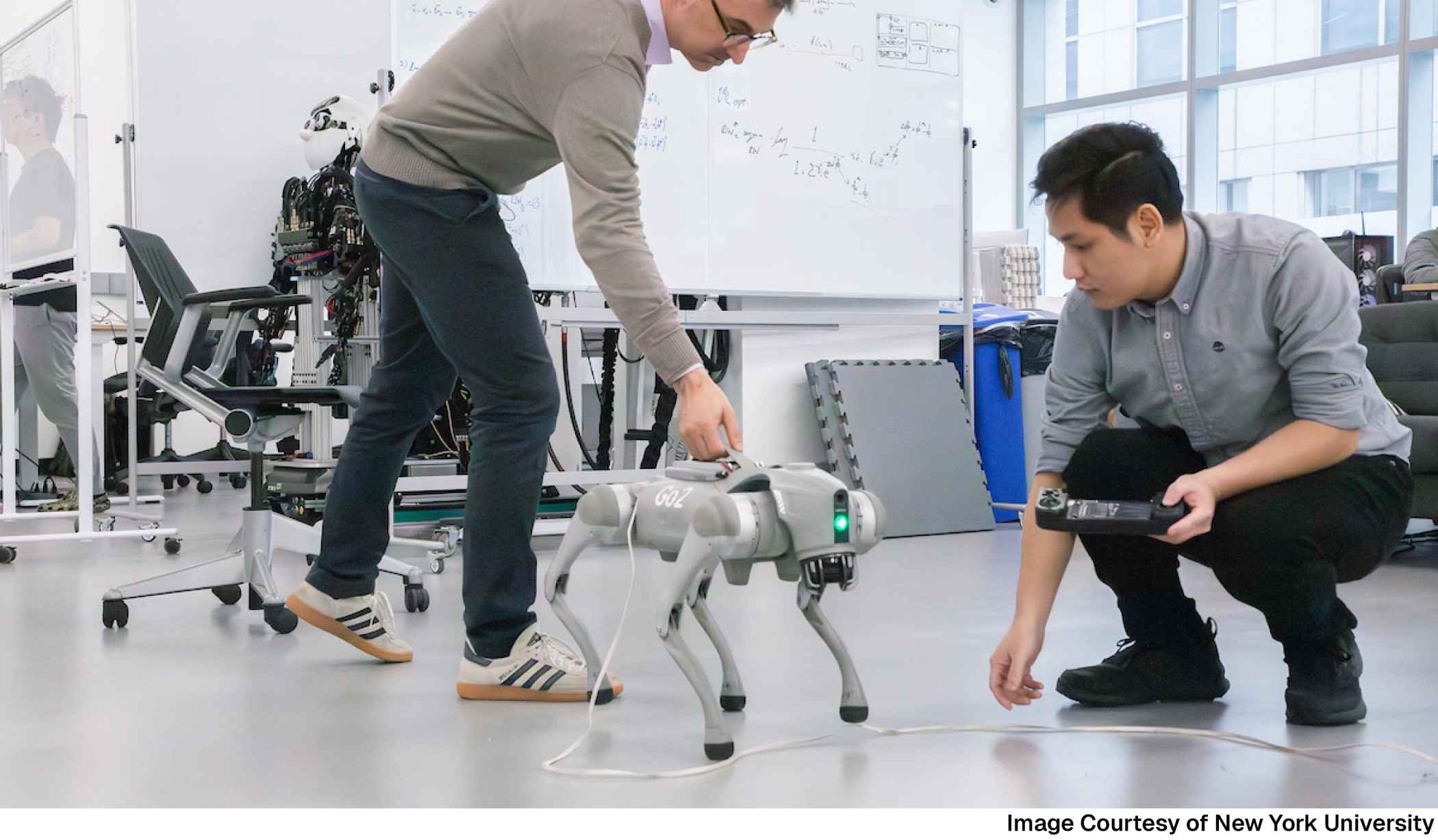

2) Breakthroughs in embodied AI

AI models trained on multimodal reinforcement learning and physical interaction data are now enabling robots to understand context, adapt to environments, and perform complex motor tasks. This improvement of ‘simulation to reality’ training increases the rate of learning and unlocks use cases previously unattainable for traditional robotics.

3) Corporate adoption and pilot programs scaling up

Major companies across automotive, warehousing, electronics, and consumer goods are already testing humanoid robotics for real‑world tasks. As use cases mature, large-scale deployments are likely through 2026–2030, and growing adoption is projected to fuel sizable demand for sensors, compute hardware, and AI training infrastructure.

4) AI investment flowing into physical automation

With the integration of frontier AI models into physical robotics, the next evolution of artificial intelligence is moving from digital-only applications to physical robotics platforms that interact with, and ultimately help shape, the real economy.

Morgan Stanley’s long‑range scenario explores a potential $5tn market by 2050 if adoption scales across industries – a view that underlines how significant the category could be over the next few decades.2

How do you see investor demand for robotics and AI-enabled manufacturing evolving in Germany and wider Europe?

As Europe’s largest industrial economy, many German companies will be focused on automation to enhance productivity, address labour shortages, and strengthen global competitiveness. Germany’s leadership in manufacturing and high robot density within the EU supports a well‑informed investor audience for robotics themes.

We are also seeing increased interest from European clients in this strategy. KOID offers an index‑based, diversified exposure to capture the broader value chain of humanoid robotics rather than single‑name risk. It is a future‑oriented theme with identifiable growth catalysts through which investors can access what we believe to be the next megatrend.

Overall, we expect demand in Germany and the broader European region to expand significantly as more investors seek exposure to the physical automation opportunity that complements the digital AI wave.

What types of companies and technologies form the core holdings of this ETF, and how do they represent the humanoid robotics ecosystem?

The ETF invests across the full humanoid robotics and embodied intelligence value chain. We break this down into three core parts: body, brain, and integrators.

The ‘body’ aspect of the ETF is made up of several distinct parts. Firstly, there are the mechanical systems which form the structural foundation of the humanoid and includes companies such as Hiwin Technologies, Schaeffler, and Leader Harmonious Drive Systems. The second largest category within the ‘body’ aspect of the ETF are the actuation systems. These provide the ‘muscles’ for movement and include companies like Tuopo, Leadshine, and Moog. The third largest category is the sensing and perception systems which allow humanoids to interpret their environment. This gives investors exposure to companies like Melexis, Robosense, and Keyence. The final section of the ‘body’ is composed of the companies involved in the mining, production, and selling of the critical materials required to build humanoids robots. This includes MP Materials, Lynas Rare Earths, and Northern Rare Earths.

The ‘brain’ of the humanoid robot is composed of the semiconductors and tech that provide the computational backbone for embodied intelligence, motor control, and sensor processing. This includes companies such as, Nvidia, Horizon Robotics, and Texas Instruments.

Finally, the integrators are the companies which focus on designing, assembling, and commercialising complete humanoid robots. Some examples include Tesla, XPeng, and UBTech.

By blending these segments, the ETF provides investors with comprehensive exposure across the humanoid robotics ecosystem, from enabling technologies to fully integrated robot systems. This diversified approach captures innovation at both the platform and component levels.

Looking ahead, are there plans to expand listings of this thematic ETF to other international exchanges or launch complementary products?

We are seeing considerable demand for KOID globally and will have additional listings in the pipeline.