Global Robotic Knee Replacement Market to Reach USD 9.8 Billion by 2036 as Hospitals Accelerate Precision-Led Orthopaedics

FMI projects 10.5% CAGR growth driven by total knee arthroplasty volumes, semi-active robotic platforms, and ecosystem-based commercialization models.

Image Courtesy: Public Domain

The global robotic knee replacement market is expanding steadily as healthcare systems prioritize precision, consistency, and scalability in orthopaedic surgery. According to Future Market Insights (FMI), the market is forecast to grow from USD 3,600.0 million in 2026 to USD 9,800.0 million by 2036, reflecting a CAGR of 10.5% over the forecast period.

Growth remains anchored in total knee arthroplasty (TKA), where robotic assistance delivers repeatable implant positioning and reduced surgical variability. Robotics is increasingly integrated into routine clinical workflows rather than being positioned as an optional navigation aid.

Key Growth Enablers Supporting Market Expansion

The market’s momentum is being reinforced by multiple structural and clinical factors, including:

• Rising global volumes of total knee arthroplasty procedures

• Increased hospital investment in digitally enabled orthopaedic platforms

• Demand for standardized alignment and reproducible outcomes

• Expansion of outpatient knee replacement programs

Together, these drivers are accelerating the transition toward robotics as a core execution tool in knee replacement surgery.

Ecosystem-Led Commercialization Gains Traction

FMI highlights ecosystem-led commercialization as a defining shift through 2036. While capital system placement remains important, revenue growth is increasingly supported by recurring components that enhance utilization and long-term value.

Key revenue contributors include:

• Disposables and consumables linked to procedural volume

• Software upgrades and service contracts

• Pre-operative planning and analytics solutions

Hospitals continue to dominate adoption due to procedural density, while ambulatory surgery centers are emerging as secondary growth avenues as care pathways shift toward cost-efficient outpatient settings. Procurement strategies are also evolving, with leasing, pay-per-use, and managed service models complementing traditional capital purchases.

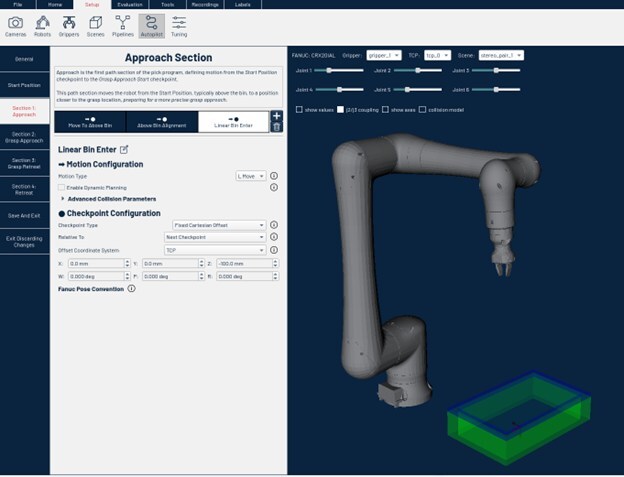

Semi-Active Robotic Systems Lead Platform Adoption

Semi-active robotic arm systems account for nearly 48% of total platform adoption, according to FMI. Their leadership is driven by seamless operating-room integration, lower learning curves, and the ability to execute surgeon-defined plans with controlled robotic assistance.

From a procedural perspective, TKA represents approximately 72% of total robotic knee replacement demand. High case volumes enable efficient amortization of robotic investments while supporting outcome-focused care models aimed at reducing revision risk.

Regional Growth Outlook Remains Broad-Based

USA (11.2% CAGR): Growth is driven by high knee arthroplasty volumes, early robotics adoption, and hospital-led standardization of orthopaedic service lines.

Germany (9.2% CAGR): Adoption is supported by a precision-focused clinical culture and preference for evidence-based robotic integration in specialty centers.

UK (8.6% CAGR): Expansion reflects selective deployment of robotics to support value-based care, workflow efficiency, and outcome consistency in high-volume hospitals.

France (8.1% CAGR): Growth is centered on centers of excellence where robotics enhances procedural standardization without disrupting operating room throughput.

Japan (7.4% CAGR): Demand is sustained by an aging population and gradual modernization of orthopaedic workflows emphasizing reliability and precision.

China (12.4% CAGR): Rapid growth is fueled by expanding tertiary hospitals, rising joint replacement volumes, and premium adoption of advanced surgical technologies.

India (13.1% CAGR): Fastest growth is driven by expanding private healthcare infrastructure, increasing osteoarthritis cases, and rising demand for precision-led elective surgeries.

Competitive Landscape Focuses on Workflow Alignment

Manufacturers are increasingly competing on ecosystem depth, workflow compatibility, and deployment flexibility rather than hardware differentiation alone. Strategic partnerships, selective distribution agreements, and modular platform offerings are being used to expand reach and utilization across hospitals and outpatient facilities.

Recent FDA clearances, platform upgrades, and system integrations underscore the industry’s emphasis on scalable deployment, surgeon choice, and digital integration.

Key Players in Robotic Knee Replacement Market

• THINK Surgical, Inc

• CUREXO, INC

• Stryker

• Johnson & Johnson

• Corin Group

• Orthokey

• Smith & Nephew Plc

• Meril Life Sciences Private Limited